For Businesses/Sellers

In January 2020, the Alaska Remote Seller Sales Tax Commission (ARSSTC) passed its Uniform Code which sets the rules for tax collection on remote sales.

As jurisdictions join the ARSSTC and adopt the Uniform Code, the rules apply to that community. Remote sales include all goods and services based on the point of delivery (destination-based sourcing).

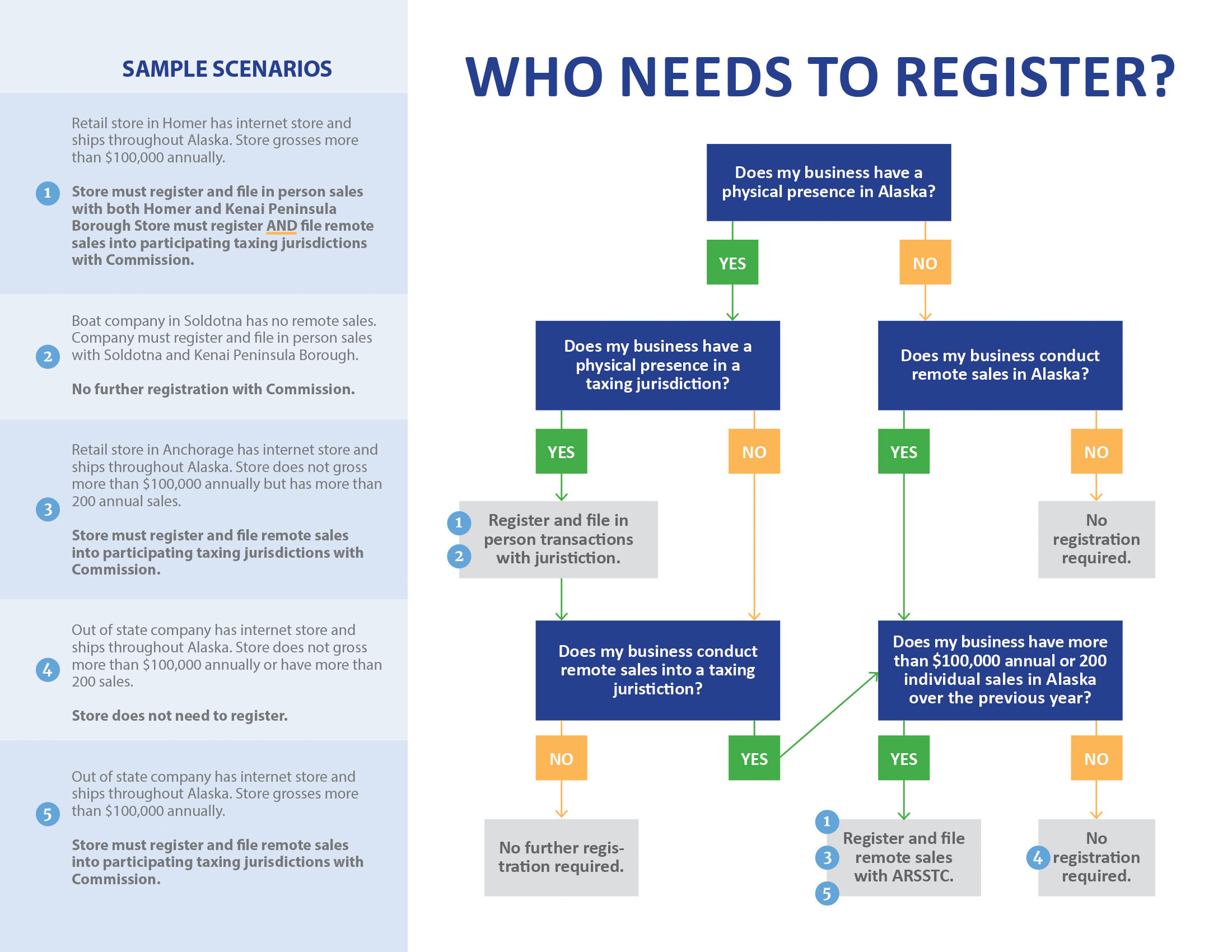

The remote sales tax rules do not apply to sales and services that Alaskan businesses send out of the state. See the Who Needs to Register chart and infographic to help determine economic threshold.

Remote Sellers and Market Place Facilitators who meet the statewide threshold of $100,000 gross sales or 200 individual transactions annually into Alaska either last year or this year, regardless of destination or taxability status of end buyer, must register with ARSSTC. The seller is expected to collect and file the applicable sales tax for remote sales into the member jurisdictions.

Determining Physical Presence:

Do not use any physical presence sales to determine if a business meets the economic threshold. Physical presence sales tax should be remitted directly to the jurisdiction and not through the ARSSTC system.

Examples of physical presence include an office, warehouse, storefront, inventory, service or sales agent, or rental of equipment/tangible property.

Out of State Sellers

For companies with no physical presence in Alaska.

Calculate economic threshold using ALL sales into Alaska INCLUDING Marketplace Facilitator sales, regardless of destination or taxability status of end buyer.

Alaskan-Based Sellers

For companies that have physical presence in Alaska and also conduct remote sales between jurisdictions.

If a company establishes physical presence in a jurisdiction, they are required to register and report all physical presence and remote seller sales (regardless of taxability) directly to the jurisdiction.

Calculate economic threshold using ONLY remote sales sent outside of the home jurisdiction(s) EXCLUDING Marketplace Facilitator sales, regardless of destination or taxability status of end buyer.

Businesses that have BOTH physical presence AND remote sales MUST SEPARATE revenue streams and file the remote sales tax with ARSSTC and the physical presence sales tax with the jurisdiction. Delivery of goods or services remotely into a seller’s jurisdiction(s) should be reported directly to the jurisdiction.

Alaskan-Based Sellers that are located outside of a taxing jurisdiction may apply for a resale/wholesale certificate through the Commission.

The ARSSTC remote sales tax rules do not apply to sales and services that Alaskan businesses send out of the state. Check the remote sales tax rules of the destination state/location for more information.

Alaska-Based Physical Presence Sellers

For companies that have only physical presence in Alaska.

All physical presence sales tax collected must be remitted directly to the relevant jurisdiction and should not be filed with the ARSSTC system.

Marketplace Facilitators

For companies that provide a marketplace to remote sellers.

Calculate economic threshold using ALL sales into Alaska from ALL Marketplace Sellers on the platform, regardless of destination or taxability status of end buyer.

Marketplace Facilitators are expected to collect and remit sales tax for ALL Marketplace Sellers on the platform for ALL sales into Alaska regardless of Marketplace Sellers’ individual capacity to meet the economic threshold.

Marketplace Sellers

For companies that sell on a marketplace.

If ALL sales are made through a Marketplace Facilitator, the Marketplace Seller does not need to register. They must fill out the Marketplace Seller Affidavit (please contact administrator for the form) and submit.

If a company sells on a marketplace as well as company website, calculate economic threshold using ALL sales into Alaska, regardless of destination or taxability status of end buyer. Seller is responsible for collecting and remitting sales tax on all non-marketplace sales into Alaska. Do not report marketplace sales on tax reporting (these sales are reported by the Marketplace Facilitator).

Seller Responsibilities

Once a seller has determined they meet the economic threshold, they must:

- Register with the ARSSTC filing portal within 30 days of meeting the economic threshold.

- Filing portal: https://arsstc.munirevs.com/

- See Resources Page/For Sellers for registration instructions.

- “Turn on” and apply sales tax collection to sales on goods and services delivered into member jurisdictions.

- If a seller is not able to initiate tax collection immediately, they must contact ARSSTC and establish a timeframe for implementation. Email amstp@akml.org for more information.

- File sales tax on a monthly schedule unless otherwise arranged with ARSSTC.

- See Resources Page/For Sellers for filing instructions.

- Sellers must file sales tax even if there was no tax collected in the filing period.

- Sellers submit a filing template that includes all member jurisdictions.

- Filings and payments must be remitted electronically through the filing portal. Please do not send paper filings or paper checks to ARSSTC or the jurisdictions.

- Business may qualify for reduced filing frequency if they have less than $100,000 taxable dollars or 12 transactions annually statewide.

- Maintain all records relating to sales and exempted transactions for three (3) years.

- The buyer is responsible for maintaining a current tax exemption certificate.

- The seller is responsible for documenting valid exemptions via certificates or other authorized means.

- Fulfill tax filing obligations and notify ARSSTC within 30 days of closing the business, selling a business, or ceasing transactions into Alaska.

ARSSTC provides resources to reduce the burden on remote sellers:

Tax filing software that provides a single access point for filing returns

arsstc.munirevs.com

- We provide a filing template with all member locations (file must be downloaded from the filing portal each month).

- The software calculates sales tax, timely filing compensation, penalties and interest.

- We provide notifications at least 30 days in advance to registered businesses regarding new members and changes to tax rates or exemptions.

Tax map software that displays official tax rates and exemptions

alaska.ttr.services

- The tax map is updated as new members join the ARSSTC.

- The tax map is GIS-based; ZIP+4 is currently not accurate to determine taxability of an Alaskan buyer.

- We offer an API code that interfaces between a point-of-sale system and the tax map.

Remote Reseller Sales Tax Exemption Certificate Application for ARSSTC Member Jurisdictions

This application is for a Remote Reseller Exemption Certificate that is valid with the ARSSTC member jurisdictions to exempt the listed Buyer of sales tax on the indicated products. This certificate is for the limited use where a remote reseller cannot obtain a local resale certificate because the reseller is not physically located in the jurisdiction where the resale occurs. For example, if you order goods for resale with a delivery address in the taxing jurisdiction, but you do not otherwise have a physical presence in that jurisdiction you may not be able to obtain a resale exemption certificate in the local jurisdiction. In that circumstance, you may apply for a Remote Reseller Sales Tax Exemption Certificate from the Alaska Remote Sellers Sales Tax Commission.